Powering everything from B2B retailers to Banks

Building the Infrastructure for Tomorrow’s B2B Finance

At Blingdale, we believe in making things different and better. What unites our portfolio is a focus on state-of-the-art software that streamline financial workflows through automation, intelligence and connectivity – all under the shared north star of improving cash flow.

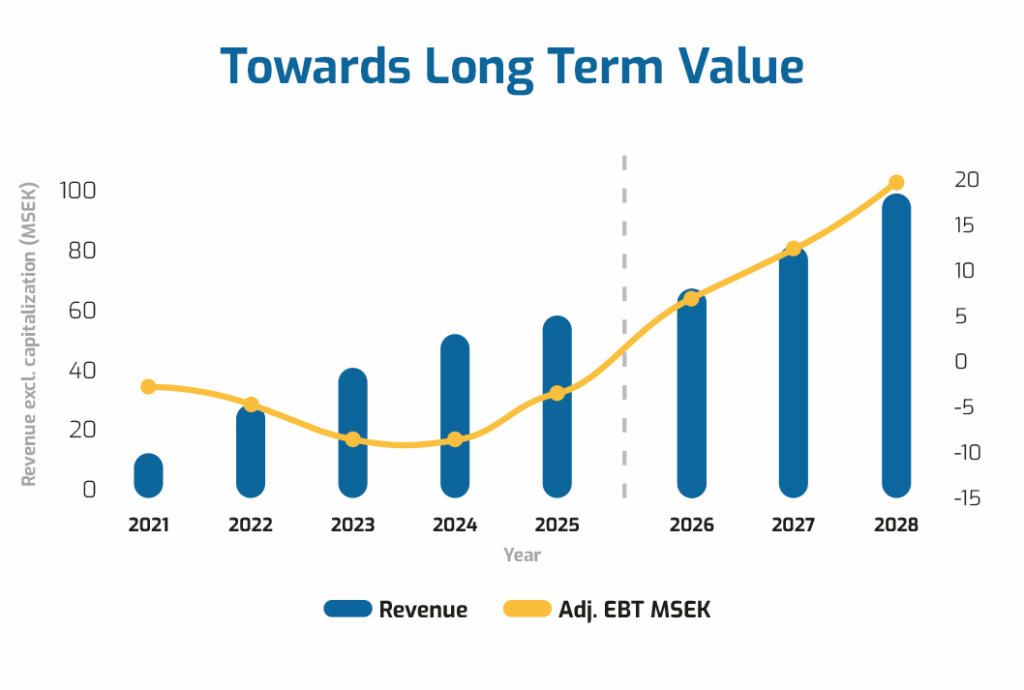

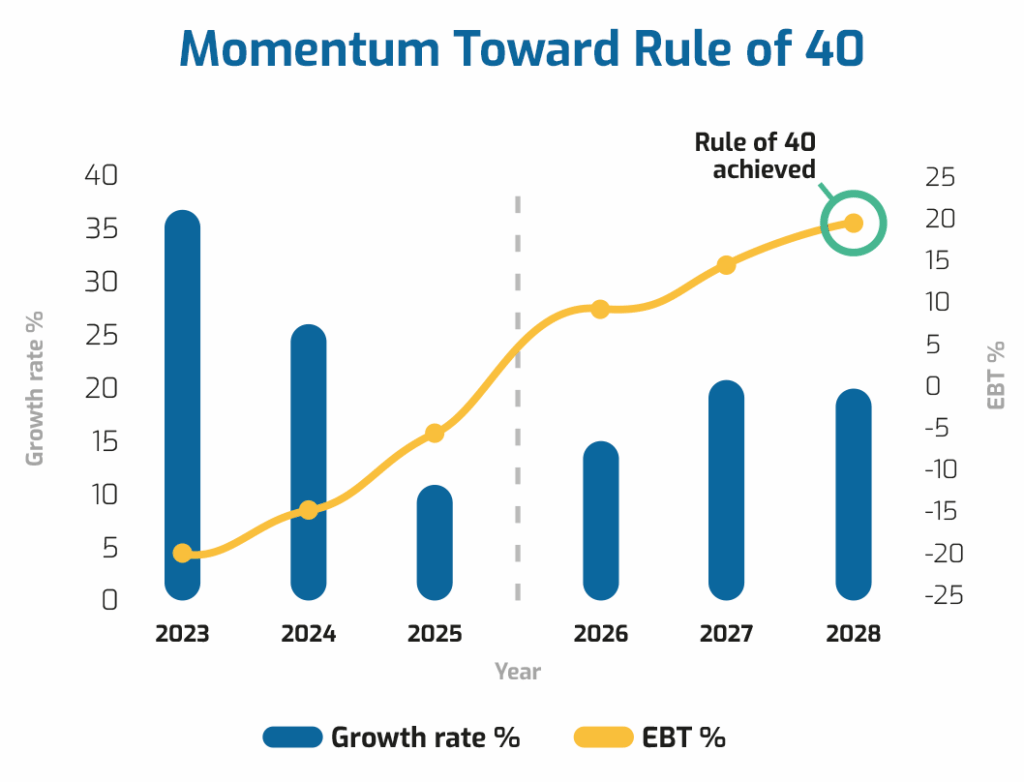

Growth with profitability

The group has doubled its total revenue since 2022, growing from SEK 30 million to 60 million in 2025, excluding capitalized development. Our sights are set on reaching 100 million by 2028.

While growth remains strong, our strategic focus is profitability. We’re shifting from scale-first to profit-driven growth, with positive EBT in clear sight, surpassing rule of 40 in 2028.

Our Brands

Our companies provide platforms and tools that streamline everything from invoicing and credit management to debt collection and system connectivity for vendors, clients and debtors.

A platform that optimizes B2B accounts receivable through automated invoicing and debt collection.

A fintech company developing credit and debt management suites with portals for operators, clients and debtors.

A low-code integration platform that connects commonly used systems in tech, finance and banking.

Meet the Boards & Management

Our boards unite entrepreneurs, venture capitalists, and tech pioneers with backgrounds spanning banking, software, and corporate finance. Among them are PhDs, seasoned CEOs, CTOs and CFOs who’ve led digital transformations and scaled businesses across Europe.