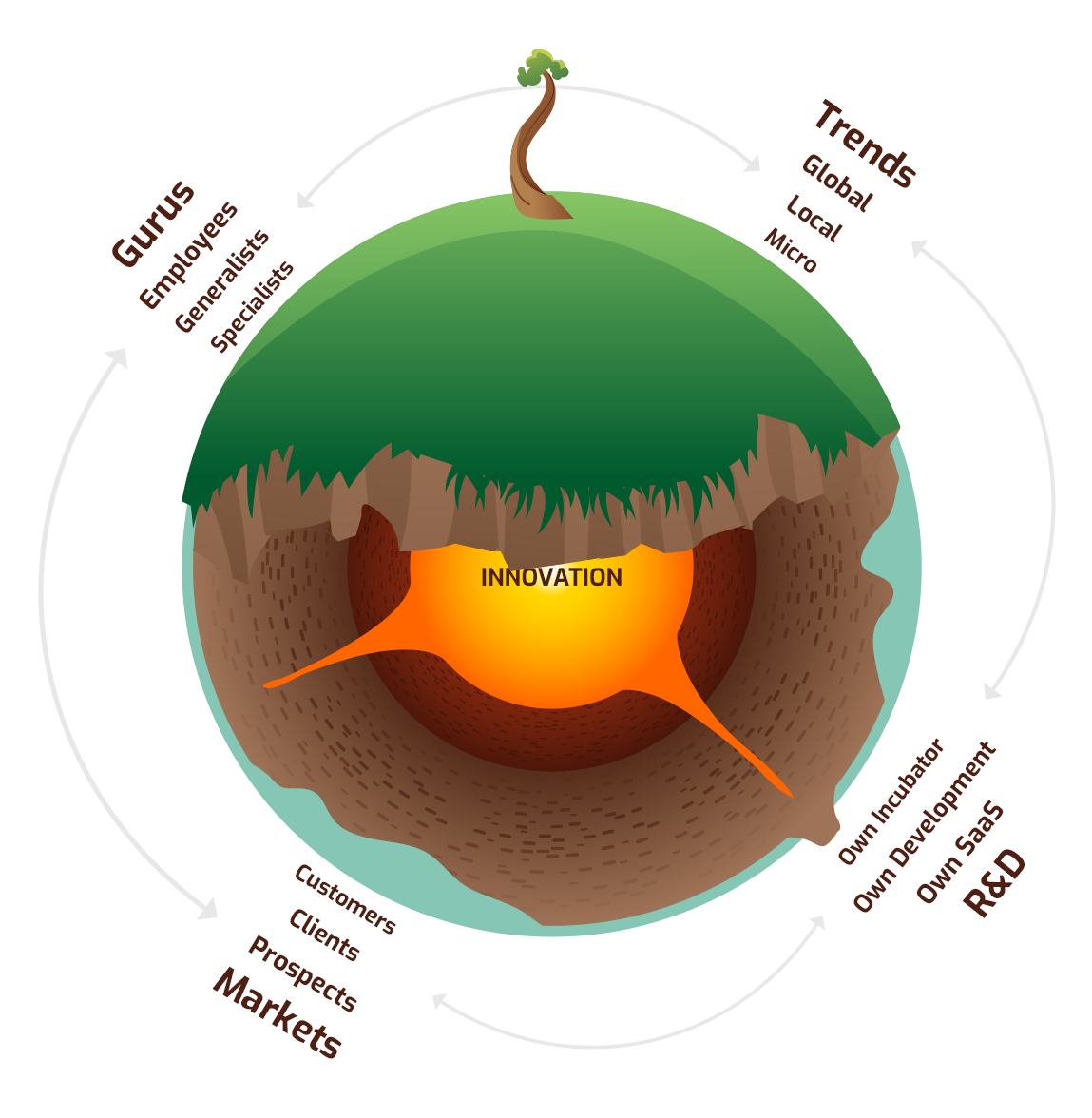

How our innovation is made

Our innovation process is a mixture of great people with a broad combined skillset, together with a hunger for understanding and creating. Evertything is done in close cooperation with existing and potential clients.

- Technology

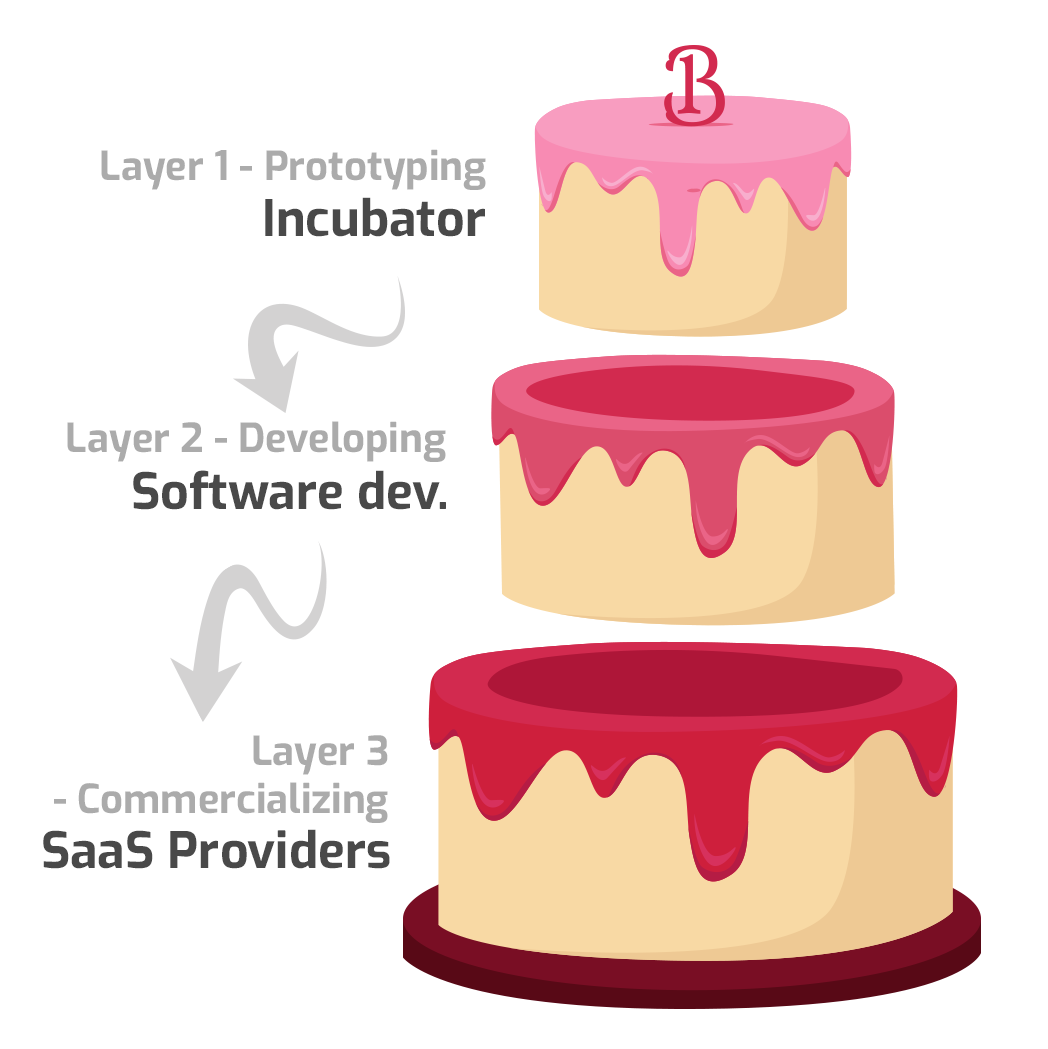

We have a deep technical understanding and combine it with data driven business knowledge. - Execution

All production is done inhouse and we own the whole chain from conceptualisation to programming and packaging. - Commercialization

We have our own unique way of profiling and positioning our products, and always strive to disrupt the current markets.